How to Get Help with Your Personal Finance Questions in the UK

- May 17, 2025

- 7 min read

Navigating the world of finance can often be complicated or daunting. Managing personal finances effectively without breaking the bank can feel overwhelming. Fortunately, there are multiple resources in the UK that offer valuable financial advice at no cost.

Whether you're looking to optimise your savings, find the best mortgage deal, or plan for retirement, financial advice can help set you on the right path. This way, you can make more informed decisions. From government-backed services to charities and independent organisations, financial advice covers everything from debt management to investments.

This article explores the best places in the UK to get financial advice online and in your local area. No matter your situation, you can access reliable support from a professional without worrying about extra costs. By knowing where to turn, you can take control of your financial well-being, avoid costly mistakes, and make the most of your money.

Continue reading to discover the best places for financial advice in the UK. We also learn about the pros and cons of each source. Additionally, we will explore common questions about financial advisers, including the types of advisers and how to choose the right one.

FinancialAdvisers.co.uk connects users with a database containing 60,000 FCA-approved financial advisers across the UK. Whether you need advice on pensions, investments, or mortgages, the site helps you find professionals who meet your specific needs.

This platform simplifies the process of finding a financial adviser. Users can search for advisers based on their location, ensuring they receive tailored financial advice. With a user-friendly interface, you can quickly locate financial advisers near you. By entering a postcode, you can discover a list of professionals, along with their address, areas of expertise, and FCA registration numbers.

Pros

Free to search a huge database of firms

Easy-to-use search tools help you find advisers nearby

Almost all advisers will offer a free initial consultation

Cons

You must contact the advisers unless you use the 'get matched' service

Review data might need to be sought elsewhere

Limited data about each adviser

Website: https://financialadvisers.co.uk/

2. MoneySavingExpert

MoneySavingExpert.com is an essential resource for anyone looking for financial advice online in the UK. Launched in 2003 by financial journalist Martin Lewis, this site has grown into a trusted platform. Its main goal is to help individuals save money in all areas of their lives, from reducing electricity bills to finding the best credit card deals.

The website is user-friendly and easy to navigate. It has distinct sections on savings, banking, and insurance. One standout feature is the forum, where users can share advice and tips. This fosters a community-driven approach, which helps individuals manage personal finance matters. Additionally, MoneySavingExpert frequently updates its content to reflect the latest changes in financial regulations and market conditions.

Pros

Free for all users

Comprehensive and up-to-date financial guidance

Access to a community forum for support

Cons

Guidance is general and might not suit specific individual needs

Some deals may not apply to everyone

Information overload can overwhelm new users

Website: https://www.moneysavingexpert.com/

3. Citizens Advice

Citizens Advice is a well-known network of independent charities across the UK. They offer free, confidential information and advice to assist people. This service addresses problems such as legal issues, financial matters, and consumer concerns. Established in 1939, Citizens Advice has become integral to community support.

Their strength lies in accessibility. Services are available online, over the phone, or through face-to-face meetings at their local branches. The website serves as a comprehensive resource. It provides advice on topics from coping financially during life changes to debt management.

Pros

Free advice available online, by phone, or in person

Covers a broad range of financial issues

Expert staff and well-trained volunteers

Cons

Long waiting times due to high demand

Advice is general and may not suit individual needs

Experience varies by local branch resources

Website: https://www.citizensadvice.org.uk/

4. MoneyHelper

MoneyHelper is a valuable resource that provides free financial advice in the UK. Backed by the government, this site offers assistance on financial matters like budgeting, investments, pensions, and mortgages.

Part of the Money and Pensions Service, MoneyHelper aims to give impartial advice to help people make informed financial choices. One unique feature is the wide range of tools and calculators available, which assist users in budgeting, calculating payments, and understanding borrowing impacts.

Users can receive support online, over the phone, or face-to-face. The website features articles and guides covering various life stages and financial challenges, promoting understanding and financial literacy.

Pros

Government-backed service providing impartial resources

Free, comprehensive tools available

Access to guidance online, by phone, or in person

Cons

General advice may not suit specific individual needs

Users may need to sift through extensive information

Information overload can be overwhelming

Website: https://www.moneyhelper.org.uk/en

5. Unbiased

Unbiased.co.uk is an online platform that connects individuals and businesses with financial professionals. The site features a directory of 27,000 qualified advisers in fields like mortgages, insurance, and accounting. Unbiased simplifies finding qualified, trustworthy professionals who can give tailored advice.

Users can search for advisers based on what they need, total assets, and location. Once you find a potential match, you can view profiles that include service descriptions and contact details. Resources like tools and articles further educate users about their financial choices.

Pros

User-friendly directory to find professionals

Access to a range of qualified advisers

Offers free initial consultations

Cons

No direct tailored financial advice

Listed professionals may charge fees

Limited coverage outside major cities

Website: https://www.unbiased.co.uk/

6. VouchedFor

VouchedFor is the leading review platform for financial advisers, mortgage advisers, solicitors, and accountants in the UK. Approximately 2 million people use it each year to find or check advisers.

Advisers listed on VouchedFor undergo a thorough verification process. Users can search and browse adviser profiles based on needs, expertise, and local area. Each profile features areas of expertise, addresses, client reviews, and ratings, which help potential clients make informed decisions.

VouchedFor also assists users in finding the best adviser nearby to complete a free Financial Health Check.

Pros

Easy-to-use search tool for finding advisers

Access to verified reviews

Free Financial Health Check available

Cons

Potential wait times for connecting with advisers

Not comprehensive; not all advisers are listed

Some profiles have inconsistent details

Website: https://www.vouchedfor.co.uk/

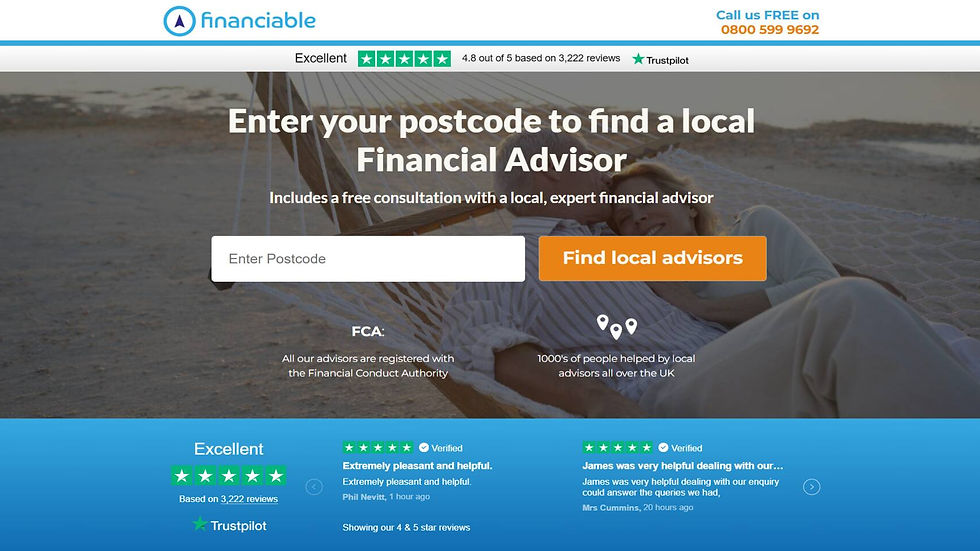

7. Financiable.co.uk

Financiable.co.uk is a free service that lets users search for thousands of FCA-approved financial advisers in the UK. The site caters to various financial needs, from mortgages and pensions to investments and tax advice.

You can enter your postcode and personal details to match with an adviser suited to your specific needs.

Pros

Free initial search available

User-friendly service

No hidden fees

Cons

Limited information on their website

Personal details need to be provided to find advisers

Limited access to tools or guides

Website: https://www.financiable.co.uk/

8. StepChange

Established in 1993, StepChange is a registered non-profit organisation providing free financial advice on debt issues. They aim to help individuals take control of their debts and work towards becoming debt-free. Solutions include debt management plans, debt relief orders, and practical steps toward financial recovery. Their services are available online or by phone, covering budgeting and money management.

StepChange has helped over 7.5 million people in the UK. Their website hosts many online resources, including tools and guides about debt management.

Pros

Free, impartial debt advice available

FCA-registered service

Access to online resources, including tools

Cons

Specialises in debt solutions only

Limited resources available in Scotland

No face-to-face advice provided

Website: https://www.stepchange.org/

9. National Debtline

National Debtline is a registered debt charity offering free expert advice on debt issues across the UK. Operated by Money Advice Trust, it helps people navigate financial challenges. National Debtline provides advice through their helpline, web chats, and a free digital tool called Money My Steps®.

Their website includes extensive resources about dealing with creditors and issues affecting credit scores. They also offer online tools that facilitate writing necessary letters.

Pros

Free impartial advice on debt matters

Well-trained advisers available

Provides advice online and through web chats

Cons

Focused solely on debt solutions

Potential wait times to receive help

No face-to-face assistance available

Website: https://nationaldebtline.org/

10. Turn2us

Turn2us is a national charity in the UK aiding people facing financial insecurity. They help individuals access benefits and charitable grants for various situations, including unemployment and health issues.

Through their website, Turn2us offers free online tools like the Benefits Calculator, which helps users determine their eligibility for benefits. The Grants Search tool connects individuals with funding and support opportunities.

Pros

Free online tools available

Provides access to benefits and grants

Information about a wide range of financial opportunities

Cons

Focused specifically on financial insecurity

Limited availability of reviews

Potential waiting times for responses

Website: https://www.turn2us.org.uk/

Conclusion

Accessing financial advice online or in your local area is achievable and beneficial. Particularly for those looking to manage their finances wisely without incurring extra costs.

Resources like government-backed MoneyHelper and platforms such as FinancialAdvisers.co.uk provide free, invaluable advice on budgeting, saving, investments, retirement planning, and more.

Different regions in the UK may offer varying options. For example, those in Scotland can consider Citizens Advice Scotland and Money Advice Scotland.

If relevant advice is hard to find, financial forums and blogs can also be a wealth of information and community support. Leveraging these resources can help individuals make informed financial decisions and empower them to build a secure financial future.

Frequently Asked Questions

1. What Is the Difference Between Financial Guidance and Financial Advice?

Typically, financial guidance offers general information to help you understand your options. It does not recommend specific products or actions. In contrast, financial advice is delivered by professionals and usually includes personalised recommendations tailored to your financial situation.

2. What Are the Different Types of Financial Advisers?

In the UK, there are two main types of financial advisers: independent financial advisers (IFAs) and restricted advisers. IFAs can access the entire market and provide unbiased advice across various financial products. Restricted advisers, like pension or mortgage advisers, can only recommend specific products.

3. How Do I Choose the Right Financial Adviser?

Start by identifying your financial needs. It could be retirement planning, managing debt, or investing. Check an adviser’s qualifications and regulatory status through the FCA register or use online services like FinancialAdvisers.co.uk to filter options. It’s also helpful to read reviews, ask about their approach, and ensure they are clear about fees.

4. How Much Do Financial Advisers Charge?

Fees vary based on the adviser and service. Some charge a fixed fee, hourly rate, or a percentage of managed assets (often 0.5%–1%). Most advisers provide a free initial consultation. However, full services usually incur a cost.